- #ONE CREDIT REPORT PER YEAR FOR FREE#

- #ONE CREDIT REPORT PER YEAR FREE#

These are the three major reporting agencies.Īlternatively, you can request the reports by calling 1-87. At, you can get reports from each of Equifax, Experian, and TransUnion. Just go to the federally authorized website.

#ONE CREDIT REPORT PER YEAR FREE#

Obtaining your free credit report is easy.

#ONE CREDIT REPORT PER YEAR FOR FREE#

The Fair and Accurate Credit Transactions Act of 2003 (FACTA), provides you with the right to view your credit report from each of the three major credit bureaus for free once every 12 months.

You can obtain your credit report for free. That will save you time when you decide to apply for a loan since you won’t have to review and potentially dispute errors when your loan application is under review, and you will not have to potentially pay excessive interest as a result. By reviewing all three of your credit reports at least once per year, you can ensure your credit stays protected continuously. You will save time and money by being proactive with your credit standing. If someone has been using your name and Social Security number to apply for credit or is making purchases with your existing credit information, you may not become aware of it unless you review your credit report. You may identify theft or credit card fraud. In situations such as this, you may not become aware of the negative impact this could have on your credit without reviewing your credit report. For example, if you cosign a loan for a friend or relative and they forgot to make a payment, it could adversely affect your credit score. Your credit may be affected by the mistakes of others. A study conducted by the FTC found that 26 percent of study participants had a minimum of one potentially material error on one of their credit reports, so it’s wise to check yours for mistakes. To identify any errors and dispute them. Additionally, you should review your report for the following reasons:

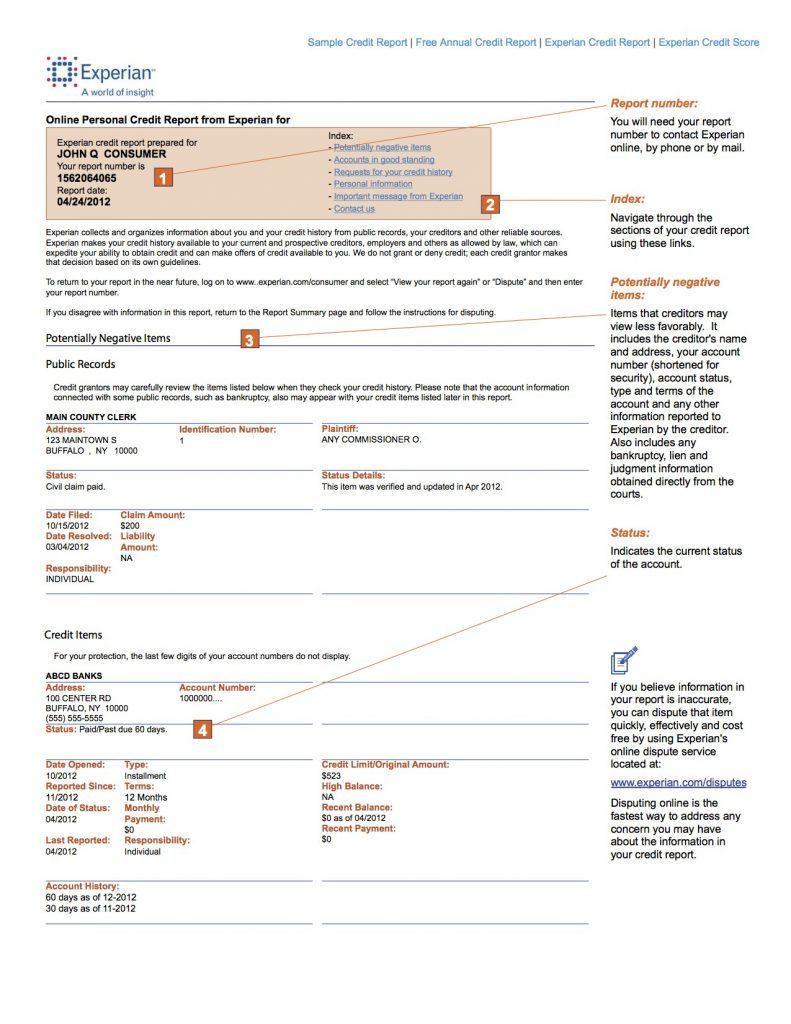

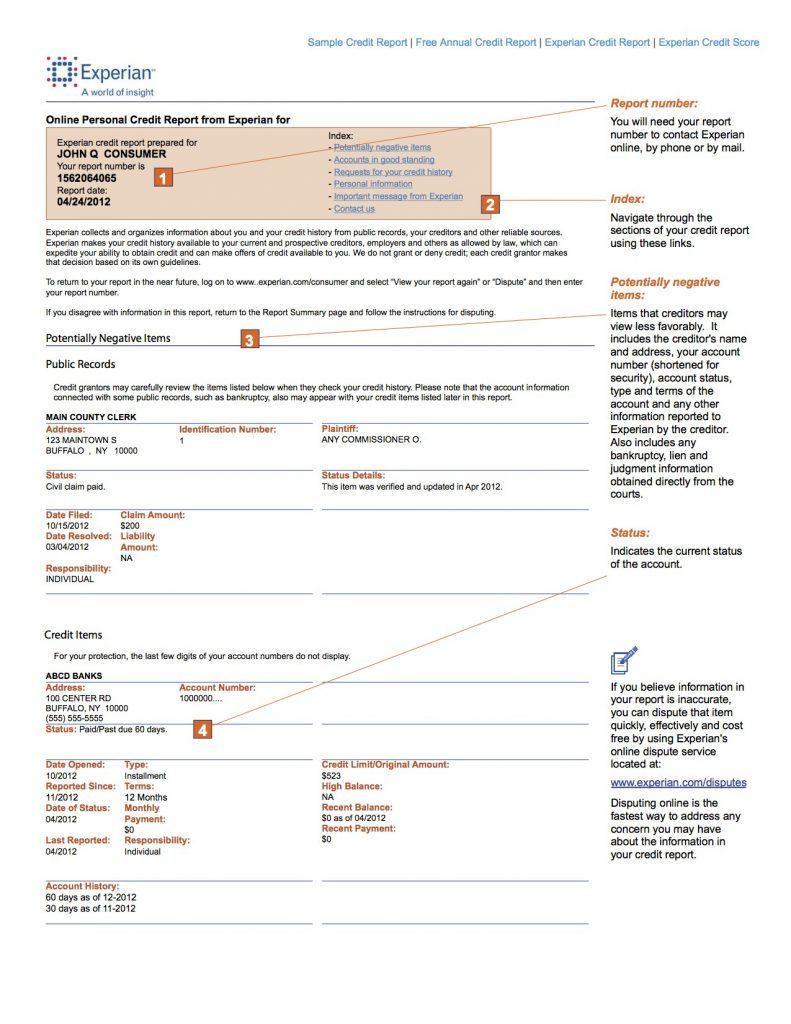

The information on your credit report can affect how much money you can borrow and the interest rate applied to the loan. Before creditors approve a new loan or line of credit, they will carefully review your past borrowing and repayment practices to determine if they want to extend you credit, and if so, how much. One of the most important things you can do is review your credit report on an annual basis.Ī credit report is a record of your personal credit history compiled by credit bureaus using data submitted by your creditors.

However, many people do not take the steps necessary to help ensure they will qualify for a loan. Having the ability to apply for and be approved for credit by a lending institution is essential for most people.

0 kommentar(er)

0 kommentar(er)